Financial integration provides key support to Belt and Road construction

2017-05-16

en.people.cn

China’s decision to inject capital into the Silk Road Fund is necessary, a senior official of China’s central bank said on May 14, stressing the importance of financial integration to Belt and Road development.

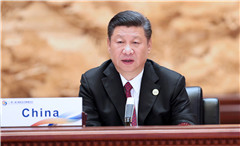

The remarks of Yi Gang, deputy governor of the People’s Bank of China, came after President Xi Jinping’s announcement that China will contribute an additional 100 billion yuan (about $14.5 billion) to the Silk Road Fund, when he addressed the opening of the Belt and Road Forum for International Cooperation last Sunday.

“It is very necessary to increase the capital of the Silk Road Fund at the current stage,” Yi said, adding that financial integration is an important support to the Belt and Road construction.

The Belt and Road countries are mostly developing economies with an enormous funding demand to solve the capital shortage in infrastructure construction and other big projects, Yi explained, further pointed out that they are in need of support from the international community to secure economic and social development.

While funding the Belt and Road construction, the fund has demonstrated its flexibility and efficiency. Having injected new capital to finance important projects, the fund guaranteed the medium- to long-term fiscal sustainability and got fair returns on its investment, Yi noted.

The official said the decision to inject capital into the Silk Road Fund stemmed from an enormous funding demand. The fund has had a large reserve of projects at the early stage, and the demand for funds will be greater in the future.

The capital boost will help the fund promote the Belt and Road construction while maximizing its advantage of lexibility and high efficiency, the official explained.

The fund with more capital will better play its leveraging role to mobilize resources of en-route countries and capital from international financial organizations, boost China’s trade and investment cooperation with other en-route countries, the deputy governor noted, adding that fruits from Belt and Road development will benefit more as a result.

He stressed at the same time that the capital boost will not change the market-oriented operating principle of the fund, which means it will be a self-financing organization that shall independently bear risks and obligations.

It will get fair returns on its investment while funding Belt and Road construction, Yi said, adding that by this way, the goal to jointly build the all-shared routes through consultation will be realized.

Based on concept of openness, inclusiveness and mutual benefit as well as the principle of internationalization, specialization, marketization since its founding, the fund has enhanced cooperation among Belt and Road countries in infrastructure construction, resource exploitation, industrial and financial sectors.

As of the first quarter of this year, the fund had signed 15 project agreements with promised investment amounting to $6 billion in aggregate. The investment covered en-route regions such as Russia, Mongolia, Central Asia, South Asia, Southeast Asia, West Asia, North Africa and Europe.

The fund has additionally allocated $2 billion to establish the China-Kazakhstan capacity cooperation fund.

President Xi also pledged at the opening ceremony that China will encourage financial institutions to conduct overseas RMB fund business with an estimated amount of about 300 billion yuan ($43.5 billion).

Designed to finance the Belt and Road initiative, the Silk Road Fund was founded in December 2014 and is jointly backed by China’s foreign exchange reserves, China Investment Corp., The Export-Import Bank of China and China Development Bank.