China steps up financial support for small and micro businesses

2017-09-27

english.gov.cn

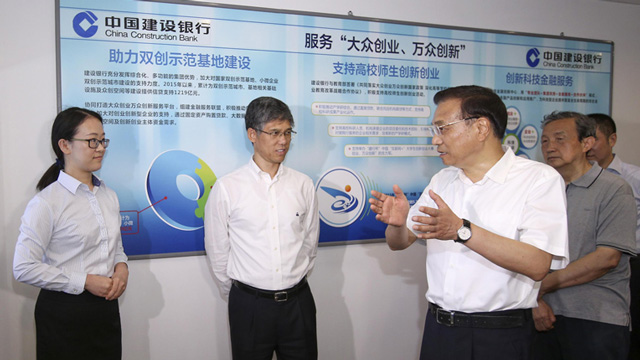

China will further bolster its small and micro businesses with more financial measures to increase vitality of the economy, according to a decision made at a State Council executive meeting chaired by Premier Li Keqiang on Sept 27.

In order to boost policy support and encourage financial institutions to step up services, the credit ceiling of VAT exemptions for interest derived from bank loans to small and micro businesses, farmers and self-employed will be expanded from 100,000 yuan to 1 million yuan between Dec 1, 2017, and Dec 31, 2019.

The stamp tax exemption for loan contracts of small and micro businesses and the VAT exemption for those with a monthly sales volume of less than 30,000 yuan will be extended to 2020.

More efforts will be made to put inclusive finance departments of State-owned banks in place at grassroots levels. Commercial banks will enjoy cuts in the reserve requirement ratio if their total or percentage of increases reach a certain threshold in individual loans of less than 5 million yuan to small and micro businesses, farmers, people under the poverty line, students and guaranteed loans for startups.

“Small and micro businesses have been a strong pillar for employment, offering strong support for large and medium enterprises, and increased the vitality of society,” Premier Li said. “We should encourage financial institutions to lower their requirements and strengthen capacities to serve the real economy.

“Financial resources should flow more to the real economy, especially to agriculture and small and micro businesses, to ease their credit crunch and high financing costs,” he said.

They have played a pivotal role in creating new jobs, as each small and micro enterprise can help create eight new jobs and each self-employed business can create 2.8 jobs, according to the National Bureau of Statistics.

The meeting decided that the government will make greater efforts to develop governmental financing guarantee and re-guarantee institutions, with a national financing guarantee fund also in the pipeline. Venture capital funds will be encouraged to devote more investment to small businesses in their early periods.

“The development of inclusive finance should be a priority, so that small and micro businesses and other weaker links can receive consistent support. The financing of small and micro businesses is a global challenge. But it is of major importance, and should be highly prioritized.” Premier Li said.

“We managed to make some progress over the years, reaching targets in growth rate of bank lending to small and micro businesses not lower than lending across the board, number of individual loans and rate for loan approvals no lower than the same period last year. Such measures have increased SMEs’ chance of survival.”

Policies for small and micro businesses should cover self-employed businesses and farmers as well, to increase policy effectiveness, he added.