Premier Li urges more VAT reform to stimulate economy

2017-09-28

english.gov.cn

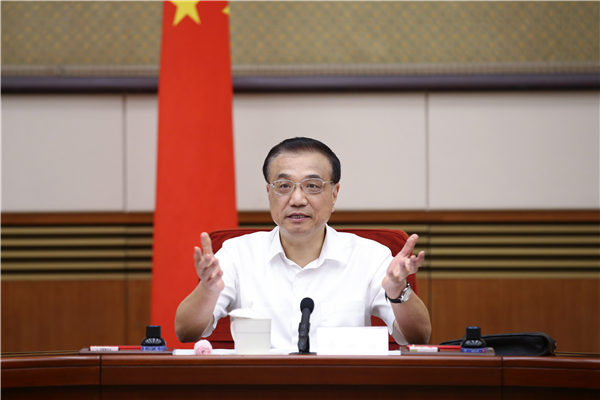

Premier Li Keqiang chaired a symposium on Sept 27 on expanding the reform of replacing the business tax with value-added tax (VAT) and improving related fiscal and tax policies.

At the meeting, the Premier heard reports from government officials of provincial regions including Shanghai, and Henan and Sichuan provinces, about the progress and achievements of local VAT pilot programs, and reports from enterprises about the tax savings brought about by VAT reform. Two professors from Peking University and Renmin University of China also offered their suggestions on improving the reform and tax policies.

They all said the VAT reform brought about many positive effects, and saved enterprises 1.7 trillion yuan in taxes so far. It has not only helped expand the tax base and increase employment, but also regulated industries, upgraded the economic structure, promoted mass innovation and entrepreneurship and created new business models and industries.

Premier Li said that in the last five years, during the implementation of VAT reform, all regions and related departments have carried out arduous work, continuously improving the policies based on actual practices. He said the reform has achieved hard-earned results, which helped provide solid support and accumulated experience for maintaining steady economic growth.

As global competition is getting more fierce, and many countries are improving their investment environment by cutting taxes, China should insist on promoting its supply-side structural reform as the main focus of expanding all-around reform and opening-up, said the Premier.

He also called for efforts to lower institutional transaction costs, forming an enabling business environment that encourages startups and innovation, enhancing industry upgrades and advocating fair competition by simplifying administration and reducing taxes and costs to inspire market vitality.

Premier Li said the government should continue to improve related policies serving VAT reform.

To ensure that tax burdens on enterprises are relieved in an all-around way, efforts should be made to integrate preferential policies during the trial period, complete tax deduction chains, and improve taxation methods, to address problems in tax deductions in financial and manufacturing sectors and small and medium enterprises.

The Premier called for enhanced taxation services to ensure enterprises can enjoy full VAT deductions. Also, he urged efforts to coordinate and simplify national and local taxation affairs, and improve taxation work with information technology.

Issuing fake VAT invoices and other tax evasion and fraudulent acts should face severe punishment, he added.

Premier Li also urged revoking and revising regulations involving the business tax as soon as possible, and pushing ahead with follow-up reforms in the VAT system, including studying and improving the standard rate of VAT, optimizing the tax rate structure, and introducing measures to further reduce tax burdens in the manufacturing sector.

Premier Li stressed dividing financial powers and expenditure responsibilities between central and local governments, and improving local tax mechanisms, for balanced development among China’s eastern, central and western regions.

In addition, the Premier asked local governments to make use of increased income from VAT reform to support socio-economic development and improve people's lives, in efforts to maintain China’s economic growth and push it to middle and high-end levels.

Vice-Premier Ma Kai and State Councilor Yang Jing also attended the meeting.