Growth stays strong in November

2017-12-01

China Daily

China’s economic growth remains resilient and the momentum may at least head into the end of this year as the country’s manufacturing Purchasing Managers’ Index picked up in November, analysts said.

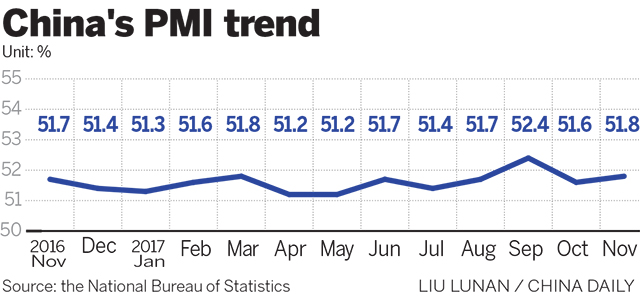

The official manufacturing PMI released by the National Bureau of Statistics on Nov 30 stood at 51.8 in November, compared with 51.6 in October.

It has remained above the 50-point mark, which separates growth from contraction, for 16 straight months.

“China’s manufacturing industry has maintained stable and rising growth momentum,” said Zhao Qinghe, a senior statistician, in a statement published on the website of the NBS.

High-tech and consumer goods manufacturing were the main contributors to the high reading in November, said Zhao.

The subindex for output rose to 54.3 in November from 53.4 in October, while that for new orders strengthened to 54.3 from 53.6 in the previous month, according to the NBS. The subindex for new export orders stood at 50.8, compared with 50.1 in October, it said.

The official nonmanufacturing PMI, meanwhile, came in at 54.8, up from 54.3 in October, the NBS said.

The rising indexes show that the effect of China’s supply-side structural reform and environmental protection measures on production can be offset by growth in consumption and exports, said Zhang Yiping, an analyst with China Merchants Securities.

“China’s economic restructuring may not have a major adverse effect on the supply and demand side of the economy,” Zhang said.

The improvement in global demand is a major factor behind the higher PMI reading in November, he said. “The improving foreign demand has a great bearing on stable manufacturing output.”

China’s fixed-asset investment, industrial output and export growth weakened in October and raised concerns that growth in the world’s second-largest economy may slow in the last quarter of this year after the country registered stronger-than-expected 6.9 percent GDP growth in the first three quarters.

But the November PMI reading shows that the Chinese economy remains resilient and the strong growth momentum may continue into the year-end and even extend to the first quarter of next year, analysts said.

“So far though, the economy remains in a sweet spot —with policymakers facing little trade-off between the conflicting objectives of growth and deleveraging,” said Tom Orlik, chief Asia economist of Bloomberg. The November PMI reading points to “continued resilience in China’s growth headed into year-end”, he said.

China’s tightening of financial policy has already hit financial markets, pushing up bond yields and caused major sell-offs in the equity market this month. But “policymakers remain in a goldilocks period, where they can make progress on the deleveraging agenda without obvious signs of a drag on growth”, Orlik said.

“A lot of people (predicted) a cyclical slowdown, but we haven’t seen that,” said Zhou Hao, senior Asia emerging markets economist at Commerzbank. “It looks like the current momentum can be sustained until at least early next year,” he told Bloomberg.

Many economists predicted that China’s GDP growth may hit 6.8 percent this year, higher than the 6.5 percent target that was set early this year.