Premier: ‘Entire economy’ to benefit from tax cuts

2018-10-05

english.gov.cn

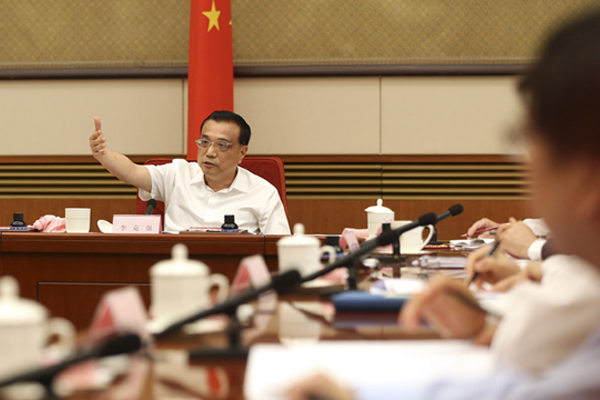

Taxes for enterprises and individuals will be reduced by more than 800 billion yuan ($116 billion) to promote the transformation and upgrading of the real economy, and stimulate market vitality and social creativity, Premier Li Keqiang said in the government work report this year.

As such, "tax cut" has been an important topic of the State Council’s executive meetings over the past six months.

State Council executive meeting on March 28

Decisions were made to deepen value-added tax (VAT) reform, further reducing tax burdens on market entities.

-From May 1, 2018, the VAT rate for manufacturing will be lowered from 17 to 16 percent, and the rate for transportation, construction, basic telecommunication services and farm produce from 11 to 10 percent.

Quotes from the Premier:

-All businesses registered in China, be they Chinese enterprises or wholly foreign owned companies, will be treated equally, and enjoy tax reductions.

-No industry should see its tax burden increase in the course of VAT reform; this will be the guiding principle of all related reform measures.

State Council executive meeting on April 18

Decisions were made that the individual income tax levied on cash bonuses researchers receive from the transfer and commercialization of technological achievements will be reduced, making innovations better serve development of the country and people’s livelihoods.

Quotes from the Premier:

-Although financial input is required to push forward technological innovation, more efforts should be made to create a new mechanism to utilize researchers’ passion for innovation.

-Respect for labor, knowledge, talent and creativity should be put into practice, honoring scientific and technological personnel who made great contributions.

State Council executive meeting on April 25

Seven more tax reduction measures were launched to drive innovation and entrepreneurship and boost the development of small and micro businesses.

Quotes from the Premier:

-Tax cuts and fiscal input are like two sides of a coin: there should be increased financial support for major scientific research projects, and tax reduction policies to catalyze corporate innovation.

-The tax cuts aim at small and micro enterprises, which benefit the entire economy.

State Council executive meeting on May 30

Decisions were made to further cut tariffs on a number of imported daily consumer goods to meet the diverse needs of the public.

Quotes from the Premier:

-Further tariff cuts will be beneficial to opening-up and meet public demand, which will also push forward quality improvements and industrial upgrading.

-Cutting import tariffs for daily consumer goods is China’s independent choice. Under the current complicated international situation and the rise of trade protectionism, we have taken the initiative to expand imports, indicating China’s determination and confidence to open wider. It is not only beneficial to China but to the world.

State Council executive meeting on Aug 30

Decisions were made to roll out new measures in tax and cost reductions to support the development of the real economy.

Quotes from the Premier:

-Tax and fee cuts are important for sustaining positive momentum of steady economic growth. All measures introduced should be fully delivered and those who neglect their duties should be punished.

-Prosperous enterprises will produce a thriving market and strong economy.

-Supervision undertaken by the State Council inspection team and the National Audit Office should be enhanced over the implementation of tax cuts. Government departments should put forward more measures to lift market burdens to bring real benefits to enterprises and the public.

State Council executive meeting on Sept 6

Decisions were made to put in place support measures for the revised Individual Income Tax Law to reduce people’s burdens.

-All departments concerned should ensure the minimum deduction threshold for individual income tax rises from 3,500 yuan ($512.40) to 5,000 yuan as of Oct 1. Clear demarcations should be made on specific deduction ranges and standards for children’s education, continuing education, healthcare for serious diseases, interest on regular housing loans, housing rent and expenditures to support senior citizens.

-Deduction ranges and standards will be adjusted along with economic development and people’s living standards.

Quotes from the Premier:

-In the face of complicated domestic and international economic situations, more measures to reduce fees and taxes should be implemented to send positive signals to society. These measures are important steps to lower enterprises’ burdens, raise the economic competitiveness of the nation and form an inseparable part of China’s administrative reform and government function transformation.

-Greater efforts should be made to tighten the government’s “three public expenses” (government’s spending on buying and using cars, traveling overseas and hosting meetings) for the benefits of enterprises and the people. I have repeated several times the government must work economically and efficiently for people’s better living.