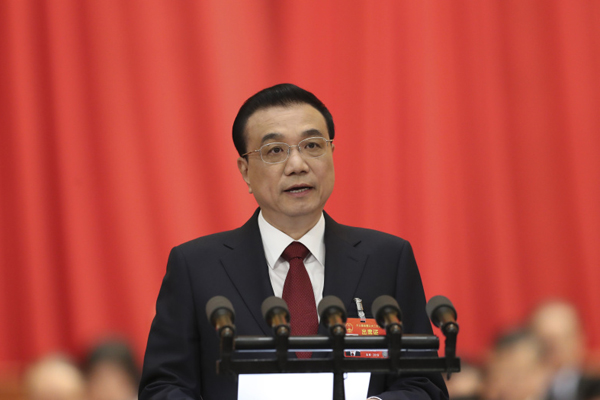

Pluses and minuses in Government Work Report

2019-03-05

english.gov.cn

“To ensure the people a good life, governments at all levels must tighten their belts,” Premier Li has reiterated this several times.

In pursing development in 2018, China faced a complicated and challenging domestic and international environment of a kind rarely seen in many years, and its economy came under new downward pressure.

Under such circumstance, let’s take a look at the pluses and minuses Premier Li mentioned in the Government Work Report of the year.

1. Minus taxes and fees, plus market vitality

We will implement larger-scale tax cuts, and we will introduce both general-benefit and structural tax cuts, focusing primarily on reducing tax burdens in manufacturing and on small and micro businesses.

VAT reform will be deepened: We will reduce the current rate of 16 percent in manufacturing and other industries to 13 percent, and lower the rate in the transportation, construction, and other industries from 10 to 9 percent, thus ensuring that tax burdens in our main industries are meaningfully reduced.

We will keep the lowest bracket rate unchanged at 6 percent while adopting supporting measures, like increased tax deductions for producer and consumer services, to see that in all industries tax burdens only go down, not up; and continue making progress toward cutting the number of VAT brackets from three to two and simplifying the VAT system.

We will ensure that the general-benefit tax cut policies issued at the start of the year for small and micro businesses are put into effect.

Premier Li also promised to reduce social insurance rate.

We will significantly reduce enterprise contributions to social insurance schemes, and we will lower the share borne by employers for urban workers’ basic aged-care insurance, and localities may cut contributions down to 16 percent.

The social insurance premium collection methods currently in operation will be kept unchanged. No locality should take any measure that increases the burden on small and micro enterprises when reforming their collection systems, or require, on their own, that longstanding arrears be paid off in a lump sum.

This year, we will reduce the tax burdens on and social insurance contributions of enterprises by nearly 2 trillion yuan.

Reducing tax and fees is a major measure to lighten the burden on businesses and boost market dynamism.

We will let market entities, especially small and micro businesses, feel the weight of their burden being meaningfully lightened, honoring our promise to enterprises and society, and seeing that no matter the number of difficulties, this important job gets done and gets done well.

He also said as long as market entities are energized, China can boost the internal forces driving development and withstand the downward pressure on the economy.

2. Minus government expenditure, plus people’s livelihood

To support the lightening of the burden on enterprises, governments at all levels must tighten their belts and find workable means of raising funds.

The central government needs to increase revenue and reduce expenditures. Profits turned in by designated state-owned financial institutions and enterprises directly under the central government should be increased; general expenditures should be cut by over 5 percent, spending on official overseas visits, official vehicles, and official hospitality should be cut by another 3 percent, and all funds that have long stayed unused will be taken back.

Local governments also need to dig deep, take big steps to improve the mix of spending, and put various funds and assets to good use through multiple avenues.

However, in terms of people’s lives, fiscal expenditure has increased. Premier Li stressed that China will develop more equitable and higher quality education. Government budgetary spending on education will remain above 4 percent of GDP, and central government spending on education will exceed one trillion yuan.

He vowed to ensure access to basic medical and health services, saying China will continue to increase basic medical insurance and serious disease insurance protection for rural and non-working urban residents. Government subsidies for resident medical insurance will be raised by an average of 30 yuan per person, half of which is to be used for serious disease insurance. And China will lower and unify the deduction line for serious disease insurance, and raise the reimbursement rate from 50 to 60 percent.

Although the pressure of maintaining a balanced budget will grow this year, inputs to ensure basic living standards will only be increased and not cut. We will support private sectors in boosting the supply of non-basic public services to meet people’s multilevel and diverse needs.

We must stay true to the vision of people-centered development and do everything within our capacity to meet people’s basic needs, resolve key problems affecting living standards, promote social fairness and justice, and help our people achieve better lives.

3. Minus government power, plus convenience for enterprises and people

Cutting the red tape has been promoted for a long period of time. In this year’s Government Work Report, another batch of minus measures has been brought up.

The Premier said China will cut government approvals and improve services to create a favorable environment for investment and business startups. The government will further shorten the negative list on market entry and promote across-the-board implementation of the policy of “entry unless on the list.” China will continue to pursue the cut certification to create convenience reform initiative, and see that businesses and the public are not saddled with running from pillar to post for certificates.

China will conduct impartial regulation to promote fair competition. The government will move faster to do away with all regulations and practices that impede the functioning of a unified market and fair competition. And see that law breakers are punished in accordance with law and the law-abiding are let be.

This will leave companies to spend more time doing business and less time chasing approvals, the Premier said, adding that delivering good services is what a government is meant to do; failure to do so means failing in its duties. We will use impartial regulation to ensure a fair, efficient, and dynamic market.

Minus on government power can result in convenience for enterprises and the public, which helps improve the business environment. This year, all permits required of businesses will be separated from the business license to make it quicker and easier for companies to get a license and start operating as soon as possible; and China will put an end to the phenomenon of “letting firms in but not letting them do business.”

Reform of the system for construction project approval will be introduced nationwide, and the time of approval needed at every stage of a project will be significantly shortened. China will encourage online approvals and services, and work faster to make it possible for such services to be accessed via one website and processed remotely. If there are more matters that do require presence in person, they should be processed at a single window, within a specified time, and without the need for a second visit, the Premier said.

Government at each level should have the courage to conduct self-reform, further streamline administration and delegate power, speed up the transformation of our functions and the improvement of our performance, and strengthen government credibility and capacity for execution to better meet the people’s new expectations for a better life.

4. Minuses and pluses in more fields

This year, average broadband service rates for small and medium enterprises will be lowered by another 15 percent, and average rates for mobile internet services will be further cut by more than 20 percent, the Premier said.

Cellphone subscribers nationwide will be able to keep their numbers while switching carriers, and cellphone packages will be regulated to achieve solid fee cuts for all consumers to see, he added.

We will cut the average electricity price for general industrial and commercial businesses by another 10 percent, Premier Li said, adding that the reform of the toll roads system will be advanced, by cutting tolls on highways and bridges.

We will speed up the development of a comprehensive listing system for the collection of fees and charges, making charge collecting open and transparent and leaving unauthorized charges no place to hide.

Talking about support for science and technology, Premier Li said that “we should fully respect and trust our scientists and researchers, and empower teams and leaders of innovation by placing more human, financial, and material resources at their disposal and giving them more power to make decisions on technology roadmaps.”

We will also work hard to cut red tape to enable researchers to concentrate on the pursuit of learning, innovation, and breakthroughs, he said.

Governments at all levels must firmly oppose and put a stop to all pointless formalities and bureaucracy in all its manifestations. We should free government employees from the mountains of documents and endless meetings, from the superfluities surrounding evaluations and inspections, and from report writing and form filling-in, and instead spend our energy on solving real problems.

We should cut down on and overhaul matters subject to inspection, checks, and evaluations, and implement an Internet Plus Inspection initiative. The number of meetings and documents will be cut. This year, the State Council and its offices and departments will lead the way in making major reductions to the number of meetings and will cut the number of documents issued by over a third.

Government works for the public; words can’t compare with actions. All levels and employees of government should be down to earth and practical and eschew doing things for show. We should let what we have achieved in reform and development speak for themselves. We should deliver a good performance in what we do.